Let’s be honest: managing money can feel like trying to fold a fitted sheet—complicated, frustrating, and never quite perfect. As a mom juggling a million responsibilities, the last thing you need is another source of stress, especially when it comes to your family’s finances.

These realistic budgeting tips are designed to transform your financial approach from overwhelming to achievable, breaking down the complex world of money management into practical, bite-sized strategies that actually work with your real life.

Budgeting isn’t about deprivation—it’s about empowerment. Every mom struggles with overspending, whether it’s those convenient online purchases that magically appear at your doorstep or the impromptu Target runs that always end with a cart full of unexpected items. The best part?

These tips are designed for busy moms—no financial expertise required. With practical tools and a supportive approach, you can transform your financial habits without added stress, creating a realistic roadmap to financial confidence that fits your packed schedule.

Key Takeaways

- Track spending to understand your financial habits

- Start with small, manageable changes

- Use apps to simplify budgeting

- Balance saving with quality of life

- Look for free alternatives to paid activities

- Focus on progress, not perfection

Tip #1: Track Your Spending with Compassionate Clarity

Understanding where your money goes is your first step toward financial confidence, but let’s keep it simple and judgment-free. Start by tracking your spending for just one month using whatever method feels most natural to you—whether that’s a user-friendly budgeting app like Mint or YNAB (perfect for automatic tracking), a basic spreadsheet, or even a notebook in your purse. Set aside 15 minutes each week to review your expenses, looking for patterns rather than critiquing every purchase. Remember, this isn’t about perfection; it’s about awareness and understanding your family’s unique financial rhythm.

Pro Tip: Create a ‘Grace Category’ in your budget. This is a judgment-free zone for those unexpected purchases that keep you sane.

Tip #2: Set Financial Goals That Actually Motivate You

Financial goals aren’t just numbers on a spreadsheet—they’re dreams with a price tag. As a mom, your goals likely go beyond just saving money. They’re about creating experiences, providing security, and building a future for your family.

Crafting Meaningful Financial Goals

- Short-Term Goals (Next 1-12 Months)

- Emergency fund of $1,000

- Paying off a specific debt

- Creating a “Mom’s Sanity Fund” for self-care and unexpected expenses

- Long-Term Goals (1-5 Years)

- Family vacation fund

- Down payment for a home

- Children’s education savings

- Retirement planning

Goal-Setting Strategies for Busy Moms

- Be Specific: Instead of “save money,” try “save $200 per month for our summer vacation”

- Make Goals Visible:

- Create a vision board

- Use a goal-tracking app

- Put a visual reminder on your fridge

- Break Down Big Goals

- Large goals can feel overwhelming

- Divide big objectives into smaller, manageable milestones

- Celebrate each small victory

Motivation Hack: Connect your financial goals to emotional rewards. Saving for a vacation isn’t just about money—it’s about creating memories with your family.

Recommended Goal-Setting Tools

- Mint: Free goal tracking and progress monitoring

- YNAB: Detailed goal-setting features

- Spreadsheet templates (many free options available online)

Remember, financial planning is a journey, not a destination. Some months you’ll crush your goals, and other months, survival mode will take over—and that’s perfectly okay. The key is consistent, compassionate progress.

Tip #3: Make the 50/30/20 Rule Work for Your Family

The 50/30/20 rule isn’t just another rigid budget formula—it’s a flexible framework that helps you allocate your money with purpose. Here’s the breakdown: 50% for needs (think mortgage, utilities, groceries), 30% for wants (family activities, that monthly subscription box you love), and 20% for savings and debt repayment. But let’s be real: these percentages are guidelines, not strict rules. Your family’s unique situation might call for different numbers, and that’s perfectly fine.

Pro Tip: If hitting these exact percentages feels impossible right now, start where you are. Even a 70/20/10 split is better than no plan at all. The goal is progress, not perfection.

Quick Reference Guide:

- Needs (50%): Housing, utilities, groceries, basic clothing, insurance, minimum debt payments

- Wants (30%): Family outings, streaming services, kids’ activities, dining out

- Savings (20%): Emergency fund, retirement, college savings, extra debt payments

Tip #4: Try the Cash Envelope System (With a Modern Twist)

Think of cash envelopes as your spending guardrails, not your prison bars. This tried-and-true method helps you stick to your budget in the most tangible way possible—when the envelope’s empty, the spending stops. But let’s modernize this classic approach for today’s busy mom life.

Modern Mom Hack: Not comfortable carrying cash? Use separate digital accounts or prepaid cards for different spending categories. Many banks now offer virtual envelope features right in their apps.

Simple Steps to Get Started:

- Choose 2-3 categories that tend to overflow their banks (like groceries, kids’ activities, or personal spending)

- Set realistic limits for each category

- Fill your envelopes (physical or digital) at the start of each month or pay period

- Track your remaining balance with a quick note on your phone

Bonus Tip: Keep a small “buffer envelope” for those unexpected expenses that always seem to pop up. This isn’t cheating—it’s being realistic about life with kids!

Tip #5: The 48-Hour Rule: Your Shield Against Impulse Purchases

That late-night shopping cart full of “must-haves” rarely feels as essential two days later. The 48-Hour Rule is simple but powerful: when something tempting catches your eye, add it to your wishlist and wait 48 hours before purchasing. This brief pause helps you separate genuine needs from momentary wants, protecting your budget without feeling deprived.

Smart Strategy: Create a dedicated “Considered Purchases” list on your phone. Note not just the item’s price, but what problem it’s solving or joy it’s bringing to your family. This helps distinguish between genuine needs and momentary wants.

Tip #6: Transform Your Grocery Shopping with Strategic Planning

A well-planned grocery list is your secret weapon against budget stress and those costly midweek emergency store runs. Take 15 minutes each Sunday to plan your family’s meals, keeping your schedule in mind—especially on those busy activity nights when you need your simplest recipes.

Your Grocery Success Blueprint:

- Check your pantry and fridge before planning (no more buying duplicates!)

- Plan meals around store sales and what you already have

- Group your list by store layout to avoid wandering (and those “oh, that looks good” moments)

- Add a small “flex fund” for unexpected needs or great deals on staples

Mom-Tested Tip: Keep a running grocery list in your phone that everyone in the family can add to. When someone uses the last of something, they add it to the list immediately. No more guessing or forgotten essentials!

Tip #7: Take Control of Your Subscriptions

Those small monthly subscriptions can quietly drain your budget—streaming services you rarely use, forgotten app trials, or subscription boxes that no longer spark joy. Set a quarterly reminder to review all your subscriptions and be honest about what truly adds value to your family’s life.

Subscription Management Made Easy:

- Truebill: Automatically finds and tracks subscriptions, plus helps negotiate lower bills

- Mint: Free option that flags recurring charges and tracks spending patterns

- Bobby: Simple app for manually tracking subscriptions with reminder notifications

- Rocket Money: Comprehensive subscription monitoring plus cancellation service

Money-Saving Hack: Before canceling a subscription, try pausing it for a month. If you don’t miss it, you know it’s time to let it go. If you do, consider sharing accounts with family members to split costs.

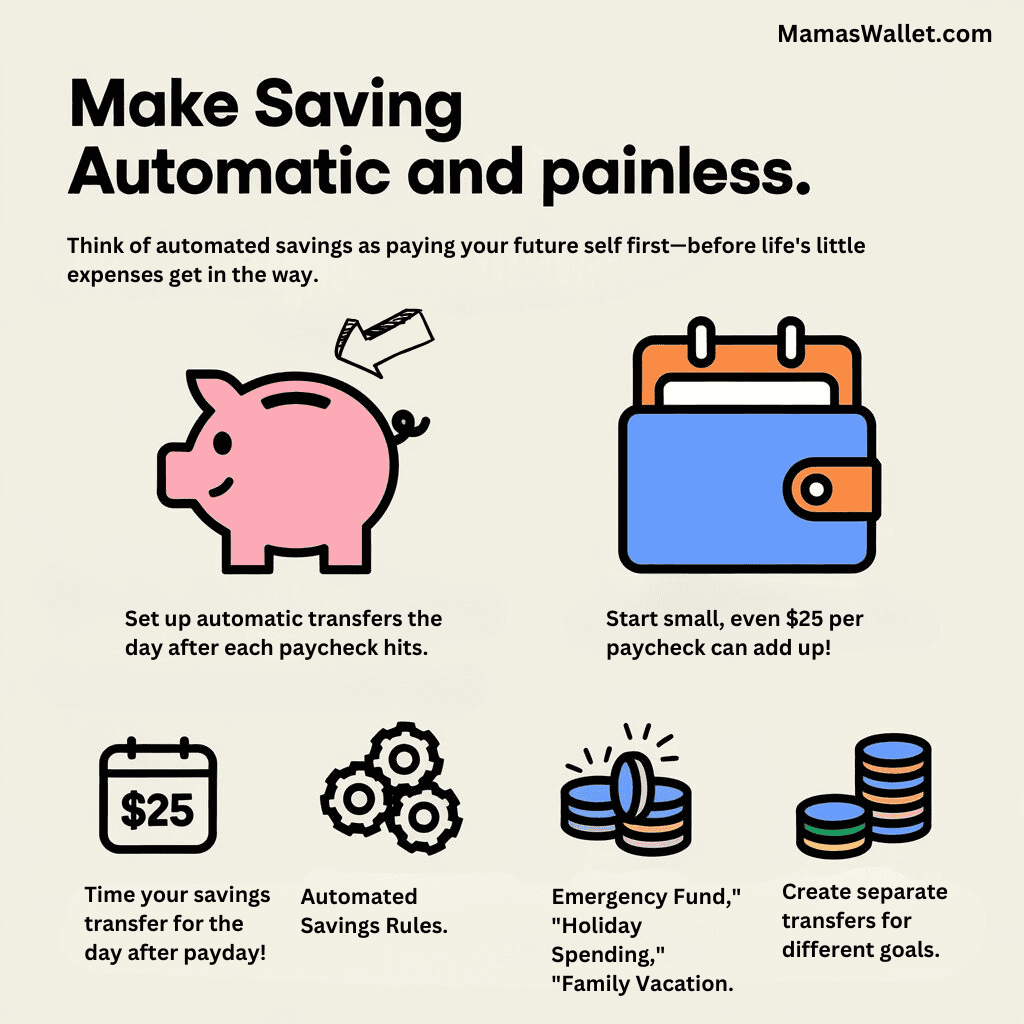

Tip #8: Make Saving Automatic and Painless

Think of automated savings as paying your future self first—before life’s little expenses get in the way. Set up automatic transfers to move money from your checking to savings account the day after each paycheck hits. Start with whatever amount feels comfortable, even if it’s just $25 per paycheck.

Banks That Make Saving Easier:

- Ally Bank: Multiple savings buckets for different goals

- Capital One 360: Automated savings rules and goal tracking

- SoFi: Round-up features and competitive interest rates

- Chime: Automatic savings when you spend

Helpful Saving Tools:

- Qapital: Create fun savings rules (like save $5 every time you hit your step goal)

- Digit: AI-powered savings that analyze your spending patterns

- Peak Money: Visual goal tracking and automated saving schedules

Smart Savings Strategy: Create separate automated transfers for different goals: one for your emergency fund, another for holiday spending, and maybe one for that family vacation. Most of these banks let you create sub-accounts with nicknames to keep your goals organized.

Pro Tip: Time your automatic savings transfers for the day after your paycheck deposits, not the day of. This small buffer prevents any overdraft concerns and helps you sleep better at night.

Tip #9: Smart Swaps That Save Big

Store brands have come a long way, and your family probably won’t even notice the difference—except for the extra breathing room in your budget. Start with pantry staples, cleaning supplies, and personal care items where generic options can save you 20-30% on each shopping trip.

Money-Saving Apps That Make a Difference:

- Ibotta: Earn cash back on groceries and everyday purchases

- Fetch Rewards: Scan receipts for points on any purchase

- Coupons.com: Digital coupons linked directly to your store loyalty card

- Checkout 51: Cash back on groceries, including fresh produce

Savvy Shopping Tip: Do a side-by-side comparison of ingredients lists rather than just prices. Many store brands are made by the same manufacturers as name brands, just with different labels.

Tip #10: Create Joy Without Breaking the Bank

Quality family time doesn’t need a hefty price tag. Your community is packed with free and low-cost activities that can create lasting memories while keeping your budget intact. The key is knowing where to look and planning ahead.

Free and Low-Cost Family Activities:

- Outdoor Adventures:

- Nature scavenger hunts

- Community garden visits

- Bike trail explorations

- Picnics in different parks

- Stargazing nights

- Beach or lake days

- Creative Home Activities:

- DIY craft afternoons using household items

- Family game tournaments

- Indoor camping adventures

- Kitchen science experiments

- Dance party competitions

- Backyard obstacle courses

- Local Library Treasures:

- Story times and puppet shows

- STEAM workshops

- Take-home craft kits

- Museum passes

- Movie streaming services

- Educational programs

- Community Events:

- Farmers market visits

- Free concert series

- Cultural festivals

- Holiday parades

- Art walks

- Fire station open houses

- Educational Fun:

- Free days at museums

- Factory tours

- Junior ranger programs at parks

- Library coding classes

- Community art classes

- School holiday events

Family Fun Hack: Create a “Free Fun Calendar” at the start of each month. Take 15 minutes to check local event listings and mark all the free activities that interest your family. Having a visual reminder helps you take advantage of these opportunities instead of defaulting to paid entertainment.

Pro Tip: Join your local “Buy Nothing” Facebook group—members often share passes to local attractions, making premium activities accessible for free!

Conclusion

Creating a budget that works isn’t about perfection—it’s about making mindful choices that align with your family’s values and goals while still enjoying life’s simple pleasures. Ready to take control of your finances? Start with just one tip from this guide, and sign up below for our free budgeting starter kit designed specifically for busy moms.

Frequently Asked Questions

Q: How much should I save each month? A: Start with what’s realistic—even 5% of your income is great. You can always increase it later as your situation improves.

Q: What if I keep going over budget despite my best efforts? A: Use overspending as information to adjust your budget categories, making them more realistic for your family’s needs.

Q: How do I get my family on board with budgeting? A: Make it collaborative with family meetings and shared goals, focusing on what you’ll gain rather than what you’re giving up.

Q: What should I do if an unexpected expense throws off my budget? A: Use your emergency fund if you have one, or temporarily adjust discretionary spending to cover the expense.

Q: How long will it take to see results from budgeting? A: You’ll notice better awareness within the first month, with significant changes visible in 3-6 months.