When budgeting on low income, most people, never consider creating a budget because they feel there is never enough money to last until the next paycheck.

When it comes to getting your finances in order, it can be stressful especially if you have a limited amount of money coming in.

[mailerlite_form form_id=4]

If this is you, then let me give you a virtual hug and tell you that not only budgeting for low income families is possible, but simple as long as you are willing to commit.

Create a workable household budget to help you to stay on track each month by paying bills on time and still have enough money for anything extra that may come up.

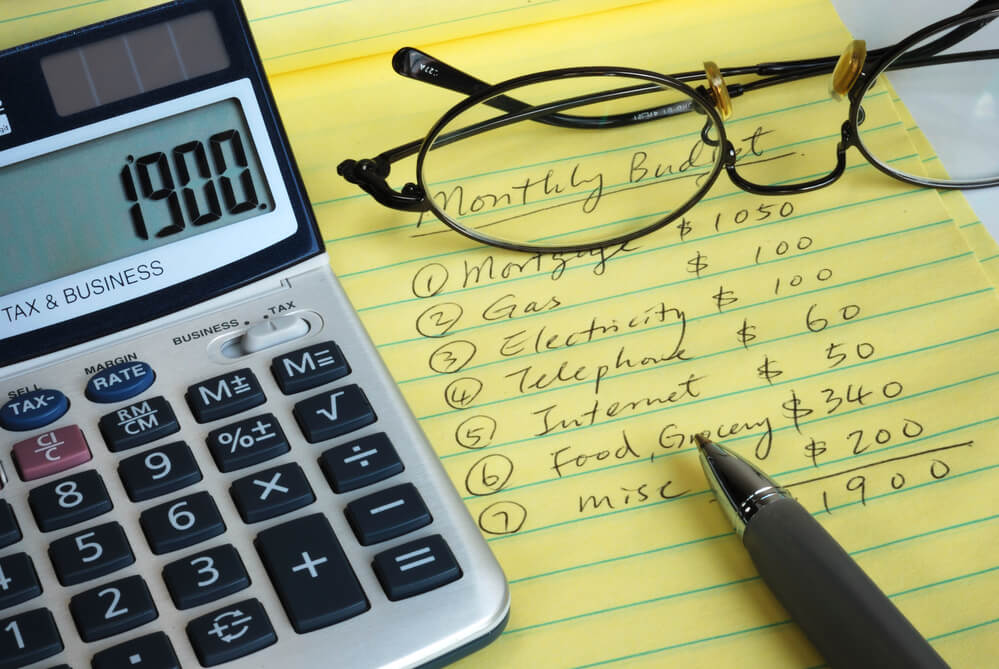

Get a spiral notebook if you prefer to write your expenses down, or use the computer to create a spreadsheet that will hold all of your information.

With either form, you will need to include your income, your monthly expenses, yearly expenses (if there are any), and room for anything else that may come up.

These would include vehicle repairs, school costs, going out to the movies, and other things along those lines.

Here are five budgeting basics to help you get started.

1. Include All Income

The first thing to do when budgeting on low income is to write it down, or on your spreadsheet would be the income.

You’ll want to include everything you may have such as paychecks, secondary income, child support, bonuses, and other forms of income.

2. Create A Savings Budgeting On Low Income

Regardless of how much income you bring in, saving is super important. Even if you feel as though there is just no room for saving, trust me there is.

It does not matter how small the amount is that you can put back each paycheck, getting into the habit of saving will relieve so much unwanted stress when emergencies come up.

The extras, in the beginning, can be hard to budget for which is why you should try to plan on them each month.

Vehicle repairs, medical copays or prescriptions, or emergencies do happen to everyone, so it is best to have a stash of cash to help ease the burden when these types of things come up.

Related Reading:

3. Budget Monthly Expenses On Low Income

The third category is the monthly expenses to write down or add to your spreadsheet.

These would include credit card payments, utility payments, loan payments, and anything else that comes up every month.

You will want to have the monthly amounts and due dates so you can place these under your income where it comes in each month.

4. Make Clear Your Yearly Expenses

This portion will more than likely not have as many expenses, but it is still important.

Do you pay your car insurance or homeowner’s insurance yearly?

Kids birthdays, a special celebration like a family reunion, or wedding anniversary.

Christmas comes every year, yet most people are so unprepared for it.

Yearly expenses may be a bit of a challenge, but this will help avoid the stress of coming up with the money when those things come due each year.

5. Can You Still Vacation?

Having a vacation can be hard when it comes to budgeting on low income, but if you plan for it, it’s possible and you will be able to include this in your month to month budget.

Having a savings account specifically for vacations will help also.

No matter if planning for a quick getaway or an extended stay, you will have the ability to stick some money back to take a vacation when you’re ready to take one.

Having a positive attitude towards your finances will help to spend your money wisely.

Budgeting on low income by writing everything down or on a spreadsheet will help to relieve financial stress.

It gives you the ability to see the big picture so that you know what you can do to increase your income and lower your expenses on an end of month basis.

[mailerlite_form form_id=4]

You May Also Like:

- How I Boost My Savings Online Every Time I shop

- 6 Of The Best Apps For Busy Moms That Will Help Keep You Organized

Pin For Later